Improve complex banking journeys with UX training

From everyday bank transfers and custody account management to Bundesbank reporting: banking applications must be secure and effective to use. To ensure the success of these digital applications, IT service provider Atruvia focuses on user centricity and trains its employees with industry leader UID. In a series of intensive training sessions, we are working together to increase Atruvia’s UX maturity level.

Effective UX training for the banking of tomorrow

Effective UX training for the banking of tomorrow

The IT service provider Atruvia is the digitalization partner in the cooperative financial group. More than 5200 employees develop B2B, B2C and B2E solutions for around 950 banks and more than 30 million bank customers. Atruvia’s goal is to personalize and optimize the financial management of bank customers so that banks and customers can benefit together and work towards a secure future. Customers should be able to handle their finances more effectively via IT applications without subjective cuts. Atruvia and UID are working towards this goal with a series of training courses in user-centered design: The topics range from data visualization to design sprints and user research.

“

“Software, data scientists and UX design naturally benefited from the UID training – thanks to concrete examples and tailored content, we received exactly the positive impetus for our work so that our customers can benefit from unique and needs-based data visualizations in the future.”

Holger Fischer, Atruvia

The process

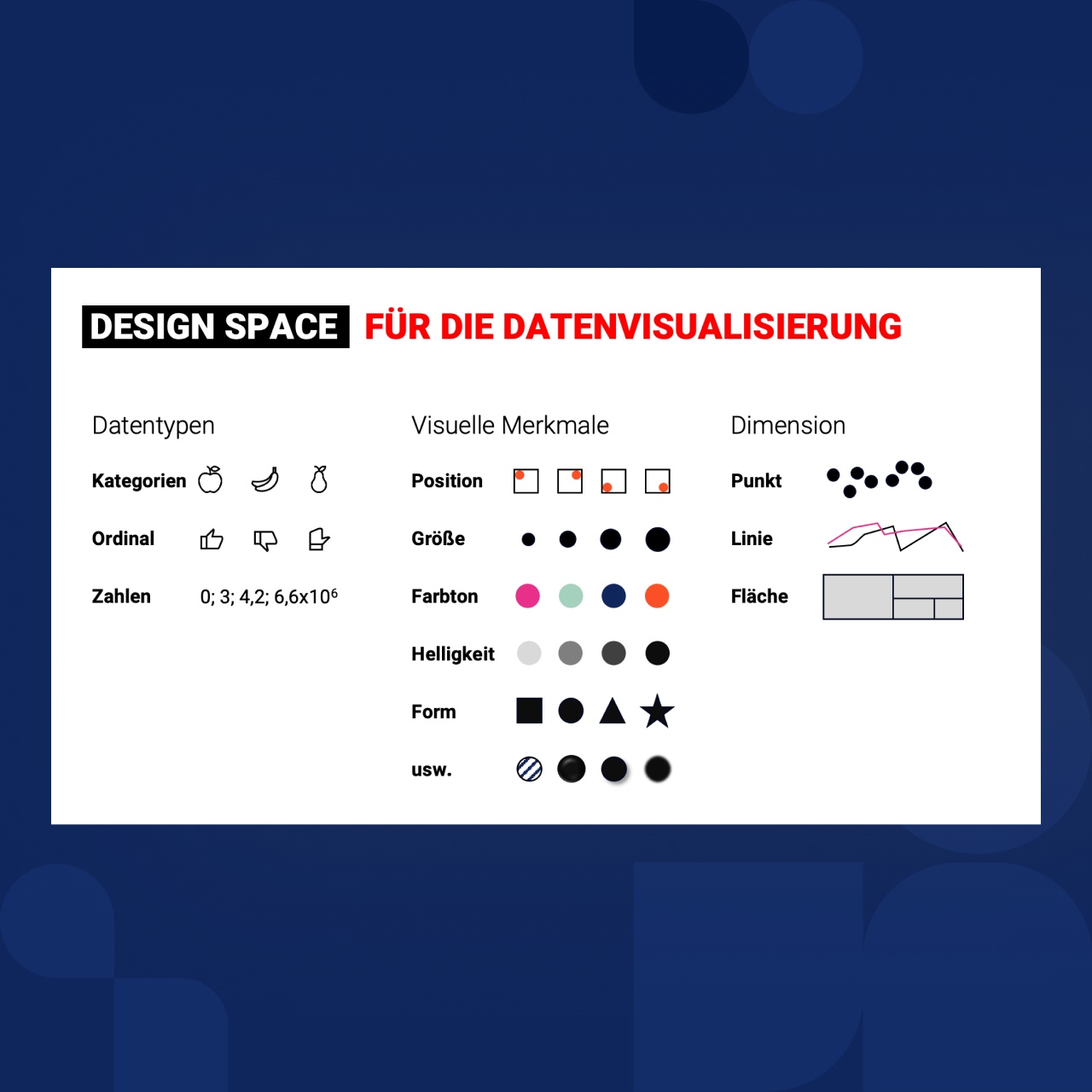

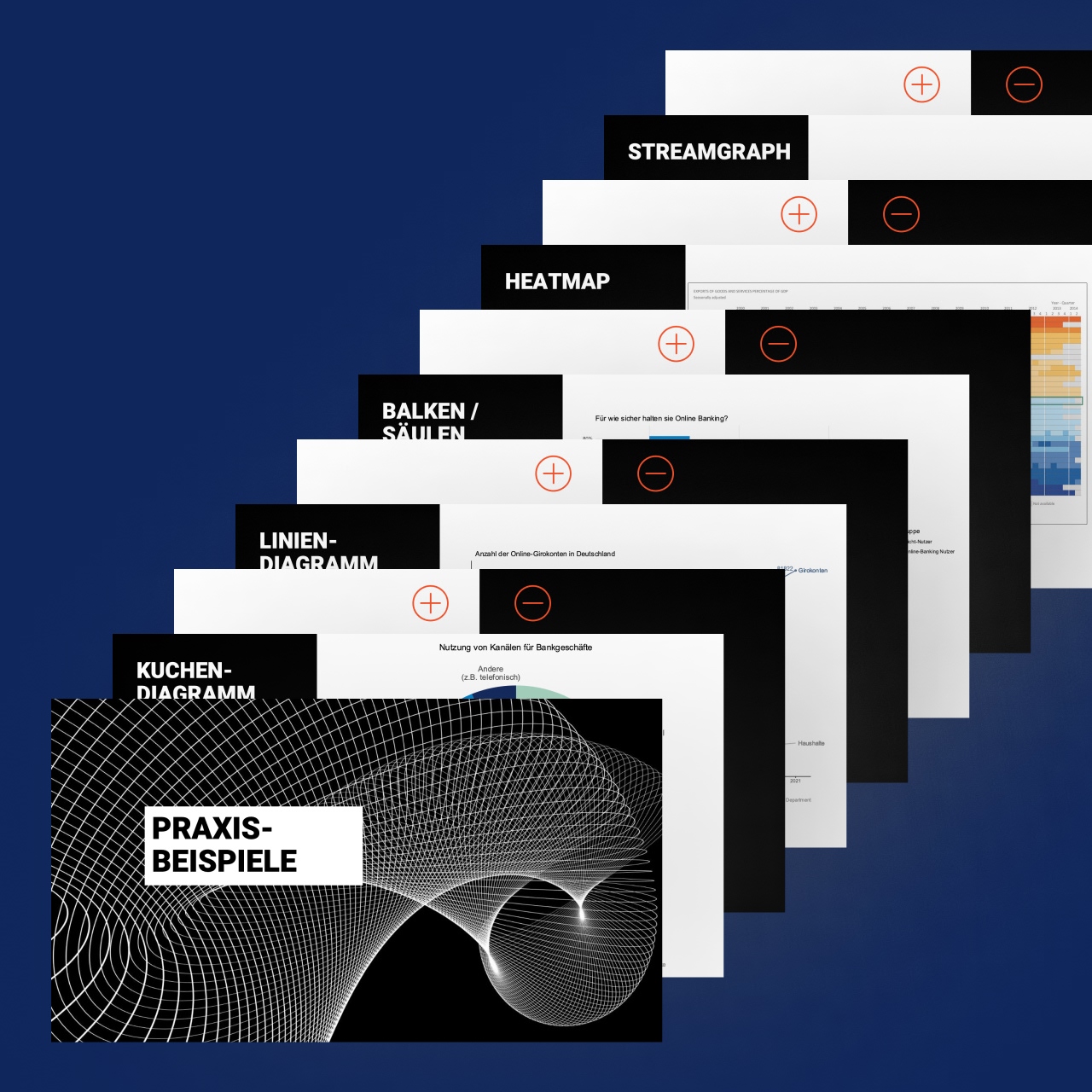

The training series kicked off with the topic of data visualization. For two days, 15 people from development and design worked on the successful design of simple and complex data and delved deep into the world of charts, tables and dashboards. In the interactive training with exercises, there was also room to discuss how data visualization can work for Atruvia and what the UX is that Atruvia wants to achieve for its customers.

The team

Steffen Neumann and Dr. Jan Seifert, two highly experienced UI designers, took on the first training course. Both have been working intensively with data visualization at UID for many years and can therefore pass on sound insights and useful practical experience to the participants.

The further curriculum now includes these focal points from the UID training: UX awareness, design systems, digital ethics and accessibility.

Ensuring market success

Thanks to the enormous investment in knowledge about user-centered design, Atruvia will be even better able to design attractive applications for secure and value-enhancing financial management in the future. Users benefit from a positive user experience, which ultimately strengthens Atruvia’s market position.

Keeping your finger on the pulse

Through the rich exchange with experienced UID trainers, participants are able to bring in new perspectives and enriching impulses. They can anchor new approaches and thus strengthen the innovative power of the organization.

Increase efficiency, reduce costs

Trained staff potentially make better decisions when designing user interfaces and take appropriate solutions. This saves costs and accelerates the development of user-friendly banking applications with high customer loyalty.

Increase UX maturity in the company

The training participants act as multipliers and transfer new knowledge to their teams. This increases the level of UX maturity and enables UX design, development and product management to design increasingly complex finance journeys as seamless digital experiences. “By the way”, knowledge building pays off in terms of employee satisfaction and retention.